DLG tops DKK 1 billion in operating profit for H1 2022

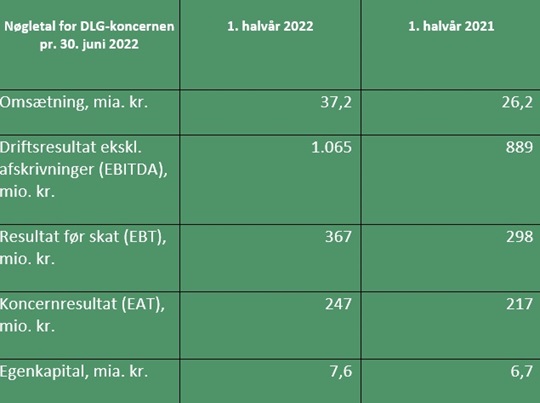

According to the financial statements for H1, the DLG Group posted revenue of DKK 37 billion for the first six months of 2022, which is an increase of DKK 11 billion relative to the same period in 2021. The operating profit (EBITDA) totalled DKK 1.1 billion, compared to DKK 900 million in H1 2021, while the profit before tax was DKK 367 million compared to DKK 298 million.

“The results for the first half of the year are highly satisfactory. I’m very pleased to announce that we are continuing on our existing course, with very impressive growth on both the top and bottom line. The significant increase in revenue is ascribable to the price increases we have seen for grains, raw materials and energy, but also to significant sales growth for our energy products in Germany. In terms of earnings, it has been a very good six months for energy and crop production in particular. The earnings growth reflects our solid market position, with our three business areas all delivering double-digit growth in earnings,” says Kristian Hundebøll, DLG Group CEO.

Russia’s invasion of Ukraine has impacted the first half of the year, including prices in the market for grain, raw materials and energy, as well as creating challenges regarding the supply of certain raw materials for feed production. The financial statements include an impairment of just over DKK 80 million on the group’s stake in the Russian vitamin manufacturer, AV Nutrismart.

“When Russia invaded Ukraine, we decided to stop all commercial activities in Russia and also to stop being co-owners of AV Nutrismart. This has, of course, meant that we had to stop doing business in several areas, and had to make an impairment, but we stand by our decision to cease all our activities on the Russian market,” says Kristian Hundebøll.

A strong half year within Food

The Food business area, which includes the two former business areas Agribusiness and Premix & Nutrition, posted revenue growth of DKK 6 billion for the first half-year.

Within Agribusiness, activities in Denmark, Sweden, the Baltics and Poland are driving the earnings growth, while the German Agribusiness business area is on budget. Crop production got off to a good start in 2022 with significant earnings growth, and it accounts for most of the growth within the entire area. In the field of animal nutrition, sales of pig feed in both Denmark and Germany have been impacted by the lower levels of activity among pig producers due to low prices for pig meat.

“We’re facing challenges within sales of pig feed as a result of the difficult market conditions for pig producers. We expect this trend to be exacerbated in the second half of the year, and as pig feed is a large business area for us, we will need to adapt to the new market conditions,” says Kristian Hundebøll.

The Vilofoss Group posted a record profit for H1 2022 as a result of strong operational results, and is now reaping the benefits of the growth strategy pursued in recent years. By focusing on improving the performance of individual farms, Vilofoss has continued to grow sales within its ‘Leading Products’ product portfolio, while also posting sales growth in the USA, Eastern Europe and the Middle East. In spite of unprecedented levels of uncertainty in the supply chain and the effect of Russia’s invasion of Ukraine, all parts of the Vilofoss Group have contributed positively to the result.

Growth within both energy and building materials

In H1 2022, the Energy and Housing business areas realised a combined increase in revenue of DKK 5 billion relative to H1 2021.

The increased levels of activity in Germany in the wake of last year’s coronavirus lockdowns boosted demand for energy products, which resulted in significant growth in sales of 22% in Team Energie.

“The energy business has been seeing strong sales, with customers rewarding us for our high reliability of supply, and we’re very pleased with the financial results for the period,” says Kristian Hundebøll.

Sales of building materials in the Housing business area increased by 7%, in particular for the building and renovation of private homes, which resulted in 15% earnings growth in H1. The growth is being driven by strong concepts and the company’s focus on providing customer advice.

“The market for building materials has been impacted by global supply challenges, but we have nevertheless managed to grow sales and earnings while maintaining our high level of service and reliable supplies for customers,” says Kristian Hundebøll.

Outlook for 2022

The harvest is well underway in several places, and although it is too early to predict the final yields, they are expected to exceed last year’s harvest yields in terms of both quantity and quality.

“We’ve got off to a good start with our new strategy – Creating the Future – which we launched in May, and which included the allocation of DKK 2 billion for investments in sustainable solutions. Over the coming months, we will provide more information on some of the exciting projects we’re working on that can help to improve agriculture’s climate accounts,” says Kristian Hundebøll, adding:

“We expect the positive trends that we’ve seen in the first half of the year to more or less continue in the second half. The geopolitical situation and the world economy may impact market developments, but based on the current assumptions, the outlook is for an annual profit which is above last year’s record profit,” says Kristian Hundebøll.