DLG Group delivers its strongest financial statements to date

Several years of focused efforts to strengthen earnings are paying off for the DLG Group, which continues the good results of recent years and presents a result for 2023 that is the second best in its history. At the same time, the group presents historically strong key figures.

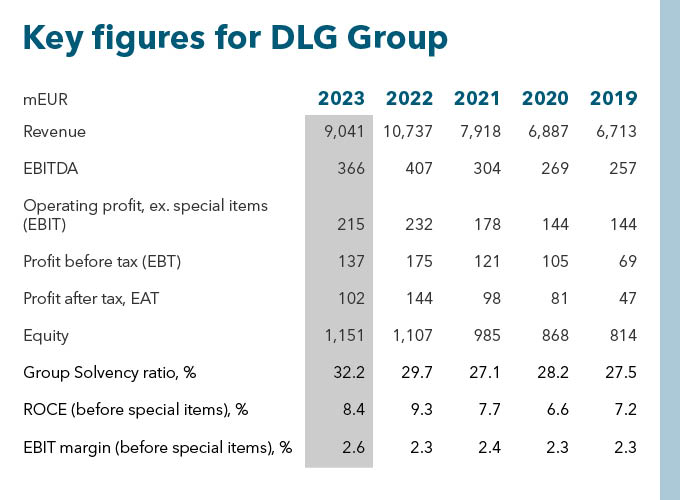

Despite challenging market conditions, the DLG Group once again delivers solid financial ratios. Total revenue in 2023 was DKK 67.4 billion, while operating profit before depreciation and amortisation (EBITDA) was DKK 2.7 billion. Profit before tax amounted to just over DKK 1 billion, translating into a profit for the year of DKK 760 million.

“We’ve navigated a still challenging market and one heavily affected by external factors such as markedly lower harvest yields, geopolitical turmoil, inflation and interest costs increasing by more than a quarter of a billion kroner. In this light, I’m pleased that we are able to deliver our second-best operating profit ever, and one that is almost on a par with last year’s profit, which was driven by historic tailwinds in the markets. Also, we’ve been able to consolidate our business further as a clear sign that our strategy is right and our business model a solid one,” says Kristian Hundebøll, CEO of the DLG Group.

The German market, which is the DLG Group’s main market, once again made a significant contribution to the results for the year, generating total revenue of DKK 43.1 billion and EBITDA of DKK 1.4 billion.

“This year marks 20 years since we first entered the German market with our investment in the energy and builders’ merchant company Team. Over time, Team has become our growth engine, and with the merger of Team and our German agricultural company HaGe, we have created an even stronger platform for continued growth under a single unified brand. Even though we are currently seeing a slowdown in the German economy, we still see great potential in this market,” says Kristian Hundebøll.

With a historically high solvency ratio in excess of 32 per cent, the DLG Group can for the first time distribute 35 per cent of its profit to members in Denmark, corresponding to DKK 184 million, or a return on the contributed capital of 11.6 per cent.

Solid efforts by business areas

“Our business serves fundamental needs in society, and our three business areas complement each other well. Our business model ensures a stable underlying demand, but there is no doubt that our success in an otherwise challenging year is also very much down to the impressive efforts of our sales organisation in winning both orders and market shares, as well as a strong cost focus,” he says.

Within the Food business area, our agribusiness in Denmark and Sweden in particular had a good year, as did our rapeseed processing activities and our eggs and poultry business. The trend of declining pig production continued in 2023, which had an adverse impact on the demand for feed, vitamins and minerals, resulting in a need for production capacity adjustments from the very beginning of the year. In addition, the whole of Northern Europe was hit by a difficult and wet harvest, where yields were almost 25 per cent lower than in 2022.

While the energy market in Germany was characterised by strong demand and high prices in 2022, things normalised during 2023. This was due to a combination of several factors, including greater price awareness among customers and lower demand due to a slowdown in the German economy. Despite the challenging market conditions, the Energy business area generated both solid and satisfactory results.

The economic slowdown in Germany and especially the higher interest rates also affected the construction industry, where we towards the end of 2022 began to see signs of a slowdown and declining levels of activity in the construction and renovation of homes. However, the results of the Housing business area were balanced by impressive results in the first half of the year and a continued focus on sales of materials for public infrastructure projects and commercial buildings.

Continued focus on transition to the future

Contributing to the sustainable transition is a key element of our strategy, Creating the Future 2030. The milestones for 2023 included the opening of insect protein company Enorm Biofactory’s first factory in December, the continued expansion of the charging infrastructure for electric cars and our investment in BioCirc, an energy company with an ambition to establish circular energy clusters on land.

In early 2023, the DLG Group’s climate targets were validated by the Science Based Targets initiative (SBTi), a partnership between the UN Global Compact, the Carbon Disclosure Project, the World Wide Fund for Nature (WWF) and the World Resources Institute.

In the autumn, the group entered into its largest financing agreement to date, which will ensure continued growth, investments and business development, including the ambition to invest DKK 2 billion in the sustainable transition. As one of the first agricultural and energy companies in Europe, DLG has linked a target of reducing indirect emissions from the value chain (scope 3) by 30 per cent by 2030 to the agreement.

“The green transition and investments in the solutions of the future are key parts of our strategy, and we’re very focused on taking the right steps and steps that make sense for our business as well as our customers and the world around us. And by linking our financing agreement to our climate goals, we’ve created a business incentive that obliges us to actually deliver on our ambitions,” says Kristian Hundebøll.

Outlook for 2024

“Our key figures speak for themselves and testify to the fact that our strategic work in recent years has created quite a solid foundation for future growth. In the coming year, half of the world’s population will be going to the polls, and no one yet knows how this will affect the world economy. As a large trading company, we’re impacted by world market developments and geared to tackling any challenges we may encounter,” says Kristian Hundebøll.